Turning supply up and down, in a wholesale market

Last time, we saw how instantaneous electricity supply power has to match instantaneous demand, in order to keep the electricity grid functioning within safe limits. Demand is mostly determined by individual consumers turning things on or off, with the exception of relatively few large industrial users who are able to turn demand down when instructed (in exchange for a cheaper rate).

The wholesale market

Supply is matched to demand by the Australian Energy Market Operator (AEMO) every 5 minutes, but how do they do this?

Because we live in a world where free and open markets are believed to deliver the most efficient outcomes, they do it using a market. Every 5 minutes, the market operator conducts an auction. Each registered generator bids an amount of electricity and a price - the minimum price they are prepared to be paid - to supply electricity to the market for the next 5 minutes. The market operator then ranks the bids from cheapest to most expensive, and proceeds down the list until enough power is booked to satisfy expected demand for the next interval.

The last and most expensive accepted bid (the marginal generator) determines the wholesale price for the period. All the generators with a bid price at or less than the marginal bid are called upon to generate at their nominated electrical power output, and all are paid at the marginal price (the last and most expensive bid accepted). This might seem wasteful, because most of the generators are being paid more than their bid price, but this helps avoid creating perverse incentives and is actually central to having the market work properly. Unsuccessful bidders do not generate power for the next 5 minute period and are not paid.

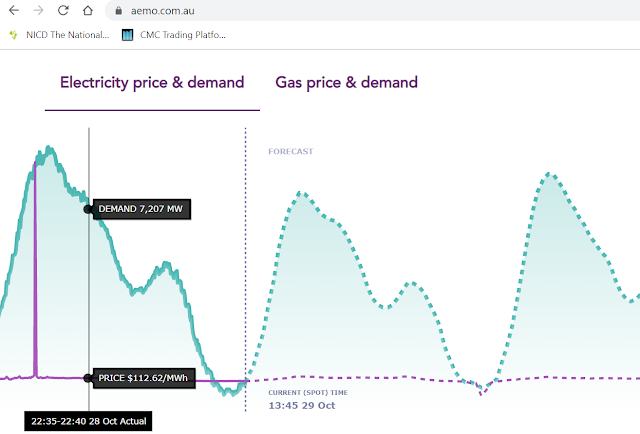

The wholesale market price is available live on the AEMO site and is quoted in $/MWh (dollars per million joules per second for an hour). Divide these prices by 10 to get units of cents per kWh - something much more familiar to retail electricity customers.

Most of us don't pay the wholesale electricity price at home (although this is possible). We purchase electricity from a retailer who buys it from the wholesale market at the wholesale price, and sells it on generally at a fixed contract price. The retailer makes a profit in the process, for taking on the risks of the sometimes wildly fluctuating wholesale prices.

The wholesale electricity market operates transparently (all the bids are visible to all the players in the market), but isn't quite a free market. Market prices are capped at the top ($15,000 per MWh), and at the bottom (-$1000 per MWh) at the time of writing. There are harsh penalties for not delivering on bids, or for reneging on other kinds of market obligations.

Turning generators up or down (or off)

Adjusting electricity generation to match demand requires individual generators to adjust their output up or down, and the auction determines who will do it. But there are limits to what's physically possible for the different electricity generation technologies used.

I'll use an analogy of a car here. Your car has a minimum operating speed, corresponding to first gear at idle - probably 5 or 10 km/hr. It has a maximum speed as well, and you can choose to drive anywhere between the minimum and the maximum speed. Every car has a most efficient speed that corresponds to minimum fuel use per kilometer travelled, probably somewhere between 50 and 80 km/hr in top gear. You car is designed to have a wide operating range to cope with a wide range of driving conditions, but this flexibility comes from compromising energy efficiency and cost efficiency.

Electricity generation machines can also be turned up or down, generating more or less electricity. But these are big pieces of machinery and it can take some time. When driving your car, bringing the speed up from 60km/hr to 100km/hr takes time, because of inertia. Motorbikes can generally do that much faster, heavy trucks take much longer. For electricity generators the same kind of effects are at play, and different kinds of generators have different characteristic response times.

Black coal generation plants are like heavy trucks. They can ramp power output up and down, but it takes hours, not minutes. They also have a minimum practical power output below which it's generally required to shut down the plant. This seems to be about 50% of nominal power output - they are not very flexible. If a full shutdown is required, it's quite difficult get moving again (just like a heavy truck). Coal plants are designed to deliver what's called baseload power, i.e. they are best operated at a consistent power output, 24 hours per day and they can generate electricity quite cheaply. Although coal fired power plants are large, complex and expensive, the energy source (coal) is quite cheap, at least in dollar terms.

Gas fired electricity generation plants on the other hand behave more like nimble motorbikes, because they have a lot less system inertia. They can significantly change their power output in only a few minutes, and can even go from not operating to full power output in something like 20 minutes. They are cheaper to build than coal fired plants, but the fuel (natural gas) is much more expensive. These usually deliver peaking power - they can step in quickly to deliver more power when that's needed at short notice, to maintain the balance on the grid. The power generated from gas peaking plants is relatively expensive, because that's required to pay back the high fuel cost and to cover the investment costs even though the plant is not operating for much of the day. Gas plants need to be very profitable when they do produce power, to cover all the times when they don't.

Renewables have become significant players in the generation mix, since the 2010's or so. Renewable just means that the energy source which is converted to electricity flows though the environment all the time, rather than being a fixed stock of fuel that becomes steadily depleted with use (and can't be re-stocked). At the moment, two main renewable energy flows converted to electricity are solar and wind - and they share an important feature. Those natural energy flows are intermittent - they are not available all the time. Solar energy flows are only available during the day, when the weather is suitable. Wind flows are available at different times, depending on the prevailing weather conditions. This means that they cannot be dispatched, or called upon to generate with sufficient reliability when demanded. AEMO categorises them as semi-scheduled, because they are somewhat predictable in the very short term. The electricity generated from solar and wind power is cheap, because the fuel cost is free. The generating plant incurs almost the same costs whether it produces electricity or not - its marginal cost of production is basically zero.

Renewables can be turned down or off very quickly. For PV solar it really is as simple as flipping a switch. For wind, it doesn't take long to change the blade pitch and lock the turbine.

The daily strategy game

These features are enough to explain a lot of what happens in the market each day.

Each electricity generator has real time demand and price forecasting from the market operator, and knows which other generators are available in the market. The electrical demand forecast is often quite accurate, the price forecasting is indicative, but often way off the actual price paid. There's an expectation about how much wind power is likely to be available given the weather forecast, likewise for solar radiation.

At midnight, there is no solar radiation. Solar operators can't bid (because they would incur huge fines if they did, and were then unable to deliver). The wind might be blowing. Wind farms want to make money, so they will bid a price at or marginally above zero, safe in the knowledge that their bid will be successful and they will supply the grid. They also know that coal power is going to fill most of the demand, and set the marginal price at which they will be paid. Coal operators bid a positive price that will be profitable, but they can't bid too high, or risk being undercut by other coal generators. Gas generators typically won't have competitive bids at this time of day because the gas will cost more than what they make from the electricity.

Looking at the weather forecast, everyone can see it's going to be a fine, sunny day. The sun comes up, and the solar plants start bidding based on how much they're able to supply at that time. Like wind power, a solar plant will make money no matter what the price is, so they bid zero or close to it. Anything earned goes straight to the bottom line, because the plant costs exactly the same every day, whether it's operating or not. Coal is still making money soon after sunrise, carrying most of the load. The solar and wind plants are generating (because they bid zero) and are getting paid at whatever rate coal is bidding.

As the sun gets higher, solar starts making more power and someone has to reduce output in order that demand is not exceeded. Coal does this, because their electricity is the most expensive in the mix. But if they shut down, it will be very time consuming and expensive to start up again. The might not be able to do that fast enough to compensate for the sun going down at the end of they day, so they turn their generators down as low as they will go (about 50%) and bid a negative price. This means they undercut the cost of solar and wind, so those guys have to shut down if supply starts exceeding demand.

Now it's midday. All of the solar panels on people's rooftops are pumping solar electricity into the grid as fast as they can. The coal plants are operating near their minimum feasible operating ranges. If the rooftop solar output is high enough, or demand is low enough, the wholesale market price can actually go negative. The lowest bid price that matches demand is a negative number, and everyone who is producing electricity will have to pay for the privilege. Except for the householders, because they don't participate in the wholesale market. They get paid their 6c per kWh anyway. Commercial solar and wind generators don't generate, because it will cost them money and they can easily switch off to avoid that. To keep things balanced, the price goes as low as it needs to go, to force enough coal generation to shut down.

Later in the day, the sun is going down and rooftop solar output is starting to drop off. The market price turns positive again. Commercial wind and solar restarts. The sun gets lower and the wind starts to drop off. The price gets higher, and coal starts ramping up to make sure there's not a shortfall. Then it's sunset. Solar output goes to zero. Coal ramps up as fast as it can, but it's not fast enough to keep pace with the falling output from solar. The wind has died off completely. Now those speedy gas fired power plants are needed - their high bid prices are accepted and the market price goes way up. This is enough for the gas fired generators to make a profit even though they're not working most of the time, and it allows the coal fired generators to make a profit tool - more than offsetting the losses they made during the day.

It's 7pm and energy demand is at its peak. Everyone is cooking dinner with microwaves and electric cooktops. The TV is likely on, as is the air conditioner or heater. The energy market is holding things together with a mixture of wind (if any), coal, and gas. Demand starts to drop as people wind down for the evening. They go to bed one by one, switching off everything but the fridge and the water heater.

Gas cycles down, as it's no longer needed. Price falls. The wind blows a little at night. Coal keeps the trains running, the data centres alive, and the streets lit.

They prepare to do it all again tomorrow. Rain is forecast though, so that changes the picture. Each generator is quietly running their models and preparing their strategy for the coming day.

Comments

Post a Comment